If you're a HNW client, see our full guide for securing a mortgage as a HNW individual. Remember, it could be worth speaking to an accountant regarding your buy to let mortgage about capital gains tax (CGT), as it could be beneficial to maintain debt on the property to avoid crystalising capital gains. Sell the property when it has hopefully appreciated in value, taking the net profits of any excess rental income and capital appreciation after repaying the mortgage in bulk.Use the rental income from the property to repay the low interest only mortgage repayments.Take out an interest only mortgage for a rental property they believe will appreciate in value.The below is a fairly common interest only mortgage strategy used by buy to let portfolio landlords: You are a buy to let portfolio landlord.

You will only need to pay back the interest on your mortgage up to the point that you’re ready to completely repay as a lump sum.īe aware that lenders will need evidence of your ability to repay your mortgage through alternative sources if this is your intention. If you’re looking to sell a second property in a few years, the proceeds of which will cover the cost of your new purchase, then an interest only mortgage could be used to bridge the gap between the transition. You have another property to sell in the future which will cover the value of the mortgage.Your income is comprised primarily of bonus and commission, or ad hoc self employed paymentsĬommitting to large, monthly mortgage repayments won’t necessarily fit into your cash flow.Īn interest only mortgage keeps your monthly commitment low, and you can pay off more considerable chunks when you have the finances to do so.Or refinancing onto a standard mortgage when you are eligible for a more favourable loan to income or loan to value ratio.įor example, an interest only mortgage could be a solution for you if:.A significant increase in your earnings or general wealth.Interest only mortgages are usually taken out when you have an alternative method to repay your loan further down the line, either via:

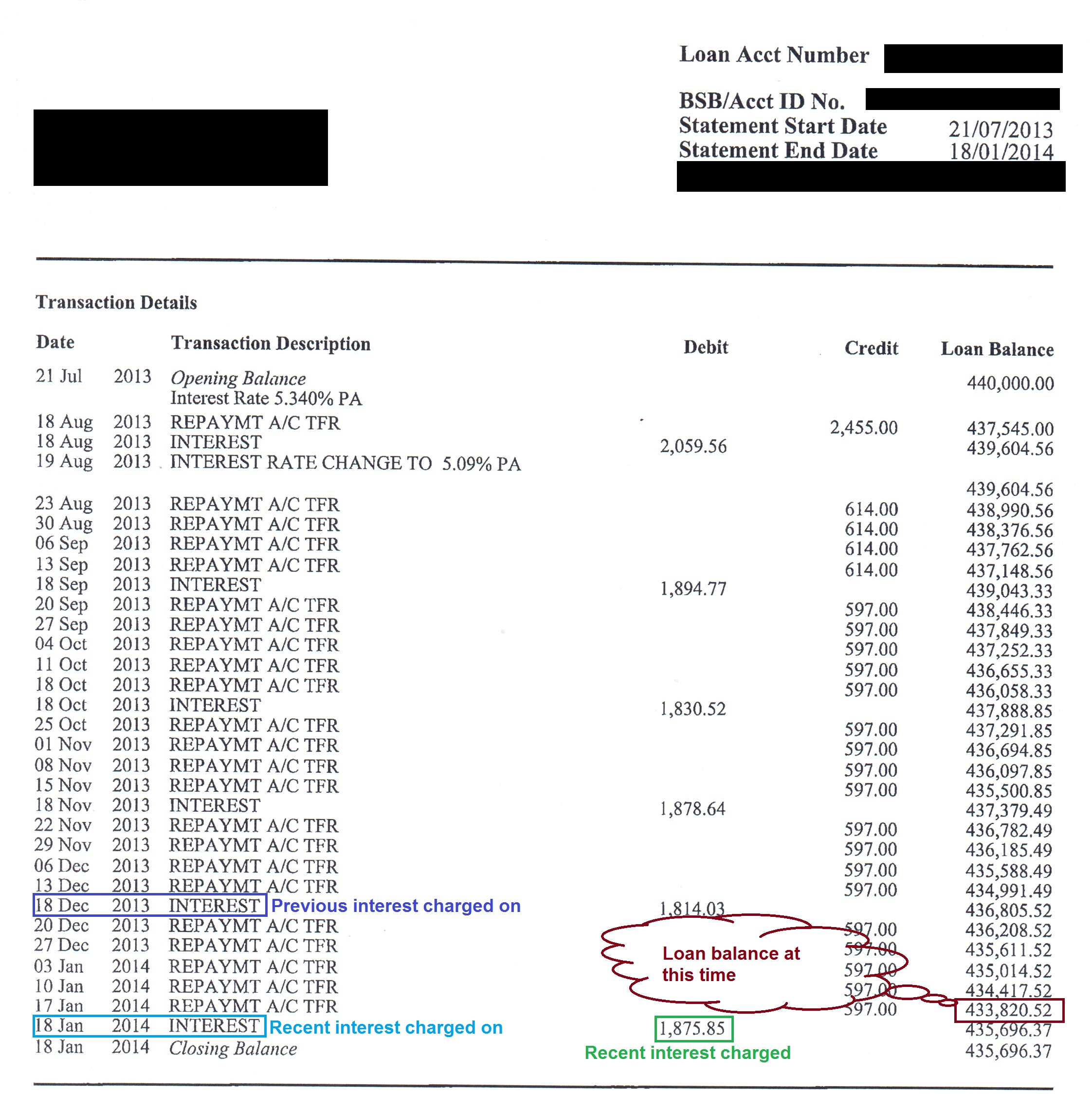

What are interest only mortgages used for? Therefore, interest only mortgages require lower total monthly payments.īut, you need another method of repaying your loan other than on a monthly basis for example, selling another property or investment. This means at the end of your mortgage term you will still owe the original mortgage amount to your bank, despite paying back the interest. With an interest only mortgage, however, each month you are only required to repay the monthly interest your loan has generated and you don’t need to repay any of the loan itself. With a standard repayment mortgage, each month you pay back the interest your loan has accrued along with a small portion of your actual loan.Īfter the full mortgage term, which could be 25 or 30 years, you will have repaid your entire loan on top of your interest payments and be debt-free. What is an interest only mortgage?Īn interest only mortgage is a mortgage that you only repay the interest on, as opposed to making capital repayments each month. Make sure that you read the separate key facts lender illustration before you make a decision. It has only been designed to give a useful general indication of costs.

0 kommentar(er)

0 kommentar(er)